Expert Suggestions And Approaches For Unlocking The Secrets To Successful Retired Life Preparation

Article Composed By-Bentley Cherry As you browse the facility surface of retired life preparation, the key to securing a meeting post-career life lies in meticulous prep work and strategic decision-making. From visualizing your retirement desires to implementing smart investment strategies, every step you take today dramatically influences your tomorrow. By unraveling the tricks of successful retirement preparation, you can open a globe of opportunities that guarantee monetary security and peace of mind in your gold years. So, are you ready to start this transformative trip in the direction of a secure and prosperous retirement?

Understanding Retired Life Goals

To begin your successful retired life preparation trip, it's important to initially recognize your retirement objectives plainly. Take some time to review what you visualize for your retirement years. Do you see on your own taking a trip the world, investing more time with household, pursuing pastimes, or volunteering? By specifying your retired life objectives with quality, you can develop a roadmap for a satisfying and financially protected future. Consider variables such as the age you prepare to retire, the sort of way of life you prefer, any type of healthcare requires, and potential tradition objectives. Understanding your goals will help you figure out how much money you need to conserve and how to designate your sources efficiently. It will likewise assist your investment choices and help you remain inspired to adhere to your retirement plan.

Structure a Strong Financial Structure

Understanding your retired life goals supplies the foundation upon which you can build a strong economic prepare for your future. To establish a durable monetary structure, beginning by producing a spending plan that outlines your present revenue, costs, and cost savings objectives. By tracking your spending routines, you can determine locations where you can cut back and designate even more funds towards your retirement financial savings. In addition to budgeting, it's necessary to build an emergency fund to cover unanticipated expenses without dipping into your retired life cost savings. Aim to reserve three to six months' worth of living expenses in a different, quickly obtainable account. Additionally, take into consideration expanding your investments to mitigate threat and make best use of returns. Explore various possession classes such as stocks, bonds, and property to create an all-round portfolio that lines up with your danger resistance and retirement timeline. Finally, regularly review and adjust your monetary plan as required to remain on track towards accomplishing your retired life goals. Developing a solid financial structure needs discipline, strategic preparation, and a long-lasting point of view to secure a comfortable retired life.

Implementing Effective Financial Investment Approaches

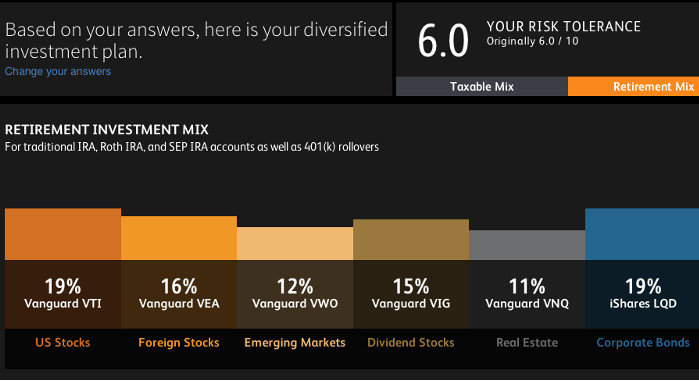

Take into consideration diversifying your financial investment portfolio to improve prospective returns and manage threat effectively. By spreading your investments across various property courses such as supplies, bonds, realty, and commodities, you can lower the effect of volatility in any single market. Diversification can aid shield your cost savings from market declines while still allowing for development possibilities. Another necessary element of effective financial investment approaches is to regularly review and rebalance your profile. Market problems change, bring about fluctuations in the value of your investments. By reassessing https://www.youtube.com/channel/UCpZ5vKkABeaNPucUePCydMw and readjusting them to keep your desired possession allocation, you can stay on track in the direction of your retirement goals. Additionally, take into consideration the influence of costs on your financial investment returns. High fees can eat into your profits gradually, so choose low-cost financial investment choices like index funds or ETFs whenever feasible. Maximizing your returns by decreasing costs is a critical part of successful retired life preparation. Conclusion Generally, successful retired life preparation requires a holistic method that deals with both financial and individual goals. By picturing https://www.ftadviser.com/companies/2024/01/26/craven-street-wealth-buys-punter-southall-s-financial-planning-business/ retired life fantasizes, establishing a strong monetary structure, and executing effective investment methods, you can set on your own up for a safe and fulfilling retired life. Bear in mind to routinely examine and change your plans as required to guarantee you get on track to attain your preferred outcomes. With devotion and technique, you can open the secrets to a successful retired life.